Rock, Paper, Scissors it Ain't: More on How the Fed Fertilizes the Rich Man's Field With the Sweat of the Poor Man's Brow

In last week's article, (1), Frederick Bastiat's insight into how inflation - what Bastiat called 'false money' - contributes to the concentration of wealth was discussed. (2) Bastiat observed that when banks create too much credit money, all prices will change, but do so over a process of many years. The speed at which some prices change and the lag at which other prices change produce the beneficiaries of inflation and its victims respectively. People whose wealth is measured in the prices of items that increase first will be rewarded by an inflation, while those whose wealth is measured in the prices of items that increase later will be punished by an inflation.

In the game of rock-paper-scissors there is no hierarchy among the three items. While a rock can smash scissors, paper - which can be cut by the scissors - can cover the rock. In short, none of the individual items can hold sway over the other two. Regrettably - and today's economic chaos proves it - there is an economic hierarchy in an economy ravaged by monetary inflation. In fact, there is a useful rule of thumb to understand the speed at which prices change in an monetary inflation. In order of fastest to slowest, this order is assets, then goods, then wages.

Assets > Goods > Wages

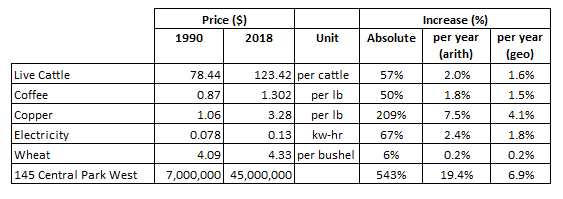

In this week's article this inflation transmission mechanism will be discussed and the basis for this discussion will be three prices from Table 1; those for electricity, wheat and 145 Central Park West.

Table 1:

Recall from last week, 145 Central Park West here is the triplex penthouse apartment in the south tower of the San Remo building in New York City. This apartment sold for $45-million in 2018 even though it was purchased for just $7-million a generation earlier. There is no explanation other than a pure monetary inflation that explains the value of this apartment increasing so much. The lion's share of the apartment's value is the physical building itself. Yet, the San Remo building was completed in 1930, almost 90-years ago, when the value of the entire building was just $10-million! The soaring price of the south tower's triplex, especially so compared to the slower rates of inflation experienced by the physical goods on this list, confirms the hierarchy of assets in an inflation ravaged economy - assets > goods > wages.

FIGURE 1:

While the price inflation experienced by the apartment demonstrates the hierarchy of assets in an inflation, what does this hierarchy of assets tell us about the sweat of the poor man's brow fertilizing the rich man's field? In order to look into this aspect of a monetary inflation, it will be necessary to consider how much electricity and wheat we would need to exchange for this apartment.

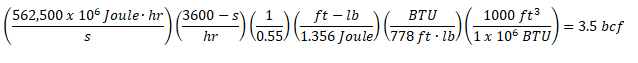

$45,000,000 worth of Electricity:

The cost of electricity from Table 1 includes the total cost to deliver the electricity to a residential customer. A fairly large fraction of this cost will be in the distribution of electricity, not the generation. For the sake of discussion here, a generation cost of electricity will be assigned a value of $0.08 per kw-hr, or $80 per megawatt-hr (MW-hr);

![]()

A typical size for a utility scale power plant is 1000-MW. So, how many days of operation is necessary to produce 562,500 MW-hr of electricity, assuming the plant runs at full-load constantly?

![]()

Finally, if the power plant is assumed to be a combined-cyle plant that burns natural gas - and natural gas is now the largest source of electricity - and there are 1,000,000 BTU's of energy per 1000-cubic feet of gas, how much gas does it take to produce all this electricity? Oh, about 3.5-billion cubic feet (bcf)!

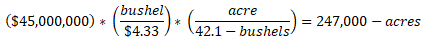

$45,000,000 worth of Wheat:

According to data from the Kansas Department of Agriculture, the ten-year average for yield from Kansas wheat farms was 42.1-bushes of wheat per acre. (A bushel is 60-lbs of wheat or roughly 1,000,000 wheat kernels)

For some perspective on this amount of farmland, there are 640-acres per mile, which makes 247,000 acres roughly 385-square miles (a plot of land 19.5-miles by 19.5-miles). Looking at it from a human effort perspective, the Kansas Department of Agriculture also reports that the average Kansas wheat farm is 781-acres which makes this production of wheat equal to the output of roughly 315 Kansas wheat farms.

DISCUSSION of RESULTS:

On the basis of the analysis here, the following all produce $45-million in sales;

- Selling a single apartment on Central Park West

- 24-days of output from a 1000-MW power plant, which itself will inhale 3.5-billion cubic feet of gas to produce this amount of power

- 247,000-acres of Kansas wheat production or the output of 315-Kansas farms

However, contrast the enormous physical effort it took to produce the electricity or the wheat versus the effort it took to sell the apartment. The entire apartment building was completed almost 90-years ago and was worth just $10-million when it was completed. The $45-million sale price of the apartment doesn't represent any 'sweat equity' put into the apartment by the owners or the realtors. The enormous disparity between the effort necessary to produce $45-million worth of electricity or wheat, and to sell the apartment have no basis in any sort economic, much less moral, sense. The disparity is a direct consequence of the unit of measure in the economy, the dollar, having no fixed value. Without a fixed value for money, the resulting economic chaos produces winners - owners off assets - and losers - wage earners.

CONCLUDING REMARKS:

The havoc that inflation wreaks on an economy and a society is incalculable. The United States is fortunate enough that most people can still afford the necessities of life, even though this is getting progressively more difficult for the average worker. However, when this isn't the case, the enormous economic inequities and injustices documented here typically spawn political unrest and revolution. Indeed, most of the great revolutions in history were first stoked by inflation. The fact that today's Federal Reserve believes we don't have enough inflation confirms the Fed knows even less about history than it does economics.

Allowing huge fortunes to be obtained simply by purchasing an asset and enjoying the fact that its price increases so much faster than other prices is hardly the limit of how inflation undermines an economy. More generally, inflation always punishes economic virtue and rewards economic vice. Nowhere is this more visible than what happens to savings under the influence of inflation.

Of the critical role savings play, not just in an economy, but in the overall advancement of society, Ludwig von Mises said,

"At the outset of every step forward on the road to a more plentiful existence is saving... Thus saving and the resulting accumulation of capital goods are at the beginning of every attempt to improve the material condition of man; they are the foundation of human civilization. Without savings and capital accumulation there could not be any striving toward non-material ends" (3)

Exactly how savings are undermined by inflation can be seen from a story that came out of the ashes of World War I Austria.

After World War I, British Prime Minister David Lloyd George often told the story of two Austrian brothers. Both brothers received an inheritance from their sober, hard-working father. One brother dutifully put his inheritance in the bank with plans to use the savings one day to help start a family of his own. The other brother, conjuring the prodigal son of the New Testament, squandered his savings in a life of dissipation. After the massive post-war inflation, the prodigal son's empty wine bottles were worth more than the dutiful son's savings in the bank. (4)

So, the next time a Fed official explains why there isn't enough inflation in the US economy reflect on the following;

- The contrast between the effort required to produce $45-million of sales in Manhattan real estate market and in a 1000-MW power plant or a Kansas wheat farm

- The role inflation has played in fomenting political unrest throughout history

- The demoralizing effect inflation has on savings - the 'beginning of every effort to improve the material condition of man.'

Peter Schmidt

Sugar Land, TX

June 21, 2020

Father's Day

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. http://www.the92ers.com/blog/exactly-how-does-fed-fertilize-rich-mans-field-sweat-poor-mans-brow

2. Again, the definition of inflation used here is the classic definition of inflation, an increase in the money supply. Exactly what form the resulting 'price inflation' takes varies with the specific economic circumstances of the time. In the 1920s, the Fed's inflation didn't produce a large amount of consumer price inflation because of the Industrial Revolution that was underway at the time. On the other hand, the Fed's inflation of the 1970s produced enormous price inflation.

3. Ludwig von Mises, Human Action, Liberty Press, Indianapolis, 1996, p. 260

4. Benjamin Anderson, Economics and the Public Welfare, Liberty Press, Indianapolis, 1979, p. 108