Quantitative Easing: Easy to Start but Hard to Stop

In the aftermath of the financial crisis peaking, universally reckoned to be the collapse of Lehman Brothers in September 2008, the Fed implemented an unprecedented campaign of quantitative easing, (QE). Though the product of MIT PhD economists, QE was quite simple. QE required the Fed to greatly expand its balance sheet. The Fed did this by creating money - trillions of dollars worth - out of thin air. The Fed then used the money it created to purchase all sorts of distressed assets from banks, primarily mortgage securities, and treasury debt. The mortgage securities and treasury debt it purchased became assets to the Fed, while the money the Fed created became a liability to the Fed and a reserve in the banking system.

The theory was, with all these reserves in the banking system, credit would be readily available to business. With all this credit available, business would borrow and the economy would recover. As the economy recovered, the Fed would then be able sell all the assets it had acquired through QE back to the financial system. As these assets were sold back, they would come off the Fed's balance sheet and the Fed's balance sheet would return to pre-crisis levels.

As the Fed embarked on the unprecedented expansion of its balance sheet, numerous Fed officials stated there would be no issues with selling the purchased assets back to the market as part of the Fed 'unwinding' or reducing its balance sheet. For a sampling of these confident predictions, see the 'how it started list' list below.

Quantitative Easing: How is Started:

- 25 MAR 2010: Ben Bernanke promises to get the balance sheet under $1-trillion. (1)

- June 2010: James Bullard of the St. Louis Fed describes the Fed's QE programs as "temporary in nature" and "always meant to be temporary in nature." (See #2, p. 156)

- 01 JUN 2014: St. Louis Fed states, "The FOMC has stipulated that the expansion of the Fed balance sheet is temporary (emphasis in the original) and that holdings will return to normal as the recovery progresses." (3)

- 14 JUN 2017: Janet Yellen cavalierly dismisses any concerns with the Fed reducing its balance sheet and compares the process to "watching paint dry." (4)

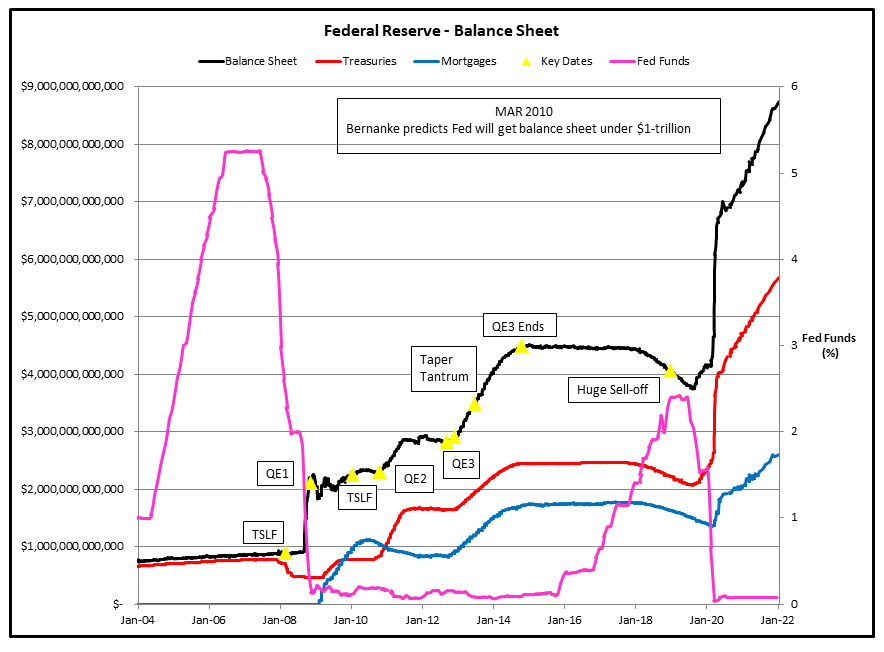

As with most issues of prime importance, the Fed was completely wrong about its ability to sell assets back to the market. The Fed's failure is transparently obvious in Figure 1. Rather than the balance sheet getting back below $1-trillion as Ben Bernanke predicted in March 2010, now - more than thirteen-years after the failure of Lehman Brothers - the balance sheet is still expanding! Prior to September 2008, the Fed never owned a single mortgage. It now owns more than $2.6 trillion of them and is still buying more; despite the fact that home prices are soaring.

How its Going: (FIGURE 1)

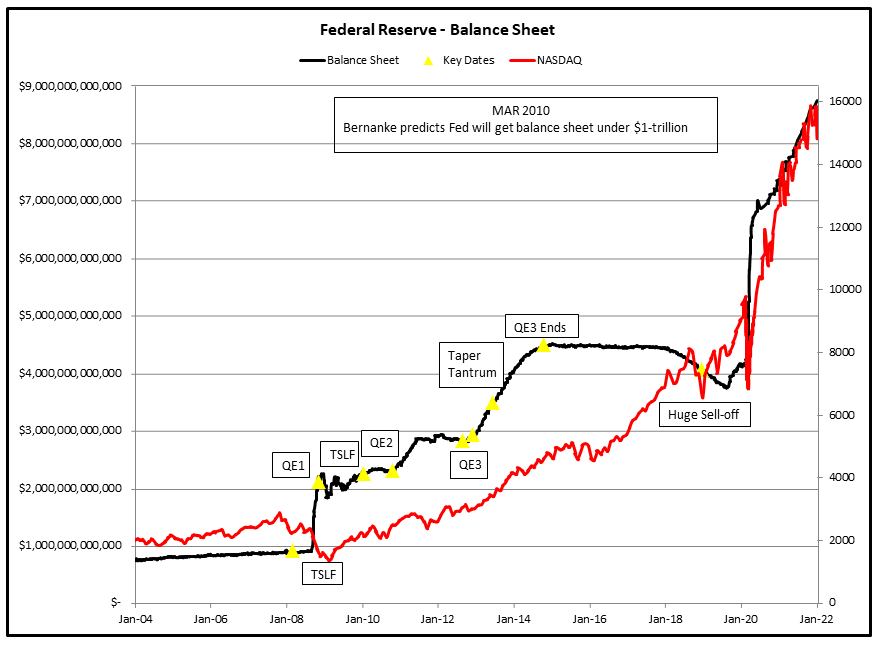

Fed apologists in the media - and Fed apologists are the only people who work in media - claim the Fed's inability to cut its balance sheet as it originally planned is the result of the pandemic. This defense is completely inconsistent with the timeline of events. Specifically, the Fed had started to cut its balance sheet in 2017, and this is seen in Figure 1. However, in December 2018 the stock market cried "uncle" and sold off - hard. See Figure 2. It was clear that if the Fed continued on its path of cutting the balance sheet, then markets would continue to sell off.

FIGURE 2: The Fed's U-Turn, Everything to do With Stocks; Nothing to do With the Pandemic

However, one of the main objectives of QE was to boost stock prices. The Fed believed the increased consumer 'wealth' from higher stock prices would spur more spending, and produce a self-perpetuating cycle of growth. In a November 2010 editorial in the Washington Post, Ben Bernanke explained what he was hoping to do with QE - at least as far as stock prices is concerned.

"...And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits, that, in a virtuous circle, will further support economic expansion." (5)

Its important to realize that about 90% of stock market wealth, is held by just 10% of the population, with a huge fraction of this wealth held by those in the financial class. Of course, it was the financial class, Wall Street in particular, that played a leading role in causing the financial crisis. So, a key tenet of Ben Bernanke's crisis recovery plan for the US economy was to enrich the people who played an enormous role in causing the crisis.

Ignoring the enormous moral bankruptcy of QE and accepting the large role stock prices play in QE, it was completely unremarkable that - with stocks selling off - Jerome Powell announced the Fed was revisiting its policy of reducing the balance sheet. On January 30, 2019 - fourteen months before the start of virus lockdowns - Fed chair Powell admitted, "The case for raising rates has weakened somewhat." (6) Soon after rates started going down again and the balance sheet started to rise again. In fact the balance sheet would be back above $4-trillion and rising long before the virus. Again see Figure 2.

SUMMARY REMARKS:

The Fed embarked on a program of QE to help the economy recovery from the financial crisis. A key aspect of QE in fostering an economic recovery would be the 'wealth' effect created by higher stock prices. Yet, the enormous and unprecedented size of the Fed's three QE programs made QE the only basis for stocks surging higher and higher. Indeed, because of QE, stocks have soared past any historical metric of valuation; total stock market capitalization versus GDP has left the highs 1929 and 2000 in the dust, see Figure 3.

FIGURE 3: Stock Market Capitalization (NYSE & NASDAQ versus GDP) (The Chartstore.com)

Now, the Fed is caught in a Catch-22 of its own making. It can try to keep its promises around the 'temporary' nature of QE and cut the size of its balance sheet. However, as the experience of December 2018 attests, any earnest attempt at cutting the balance sheet will almost certainly cause stocks to sell off. Not only will a sell-off of this type undermine one of the main objectives of embarking on QE, an unordered sell-off of stocks from their current nosebleed heights would likely spark the next economic crisis. Whatever ends up happening, don't feel any pity for the Fed. They've been sowing the quantitative easing wind, reaping the asset bubble crash whirlwind simply comes with the territory.

Peter Schmidt

January 23, 2022

Sugar Land, TX

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Follow me on Twitter @The92ers

ENDNOTES:

1. See the video, starting around the 1:04 mark;

https://www.youtube.com/watch?v=v4He1m2a5jg

2. James Bullard, "The Lessons for Monetary Policy from the Panic of 2008," Federal Reserve Bank of St. Louis Review, May/June 2010, pp. 155-163

https://files.stlouisfed.org/files/htdocs/publications/review/10/05/Bullard.pdf

3. Christoper J. Waller and Lowell J. Ricketts, "The Rise and (Eventual) Fall of the Fed's Balance Sheet," Federal Reserve Bank of St. Louis, January 1, 2014

https://www.stlouisfed.org/publications/regional-economist/january-2014/the-rise-and-eventual-fall-in-the-feds-balance-sheet

4. Yellen said, "My hope and expectation is that when we decide to go forward with this plan, (reducing the balance sheet), there will be very little reaction to it, that's how we intend to proceed, and that this is something that will just run quietly in the background over a number of years, leading to a reduction in the size of our balance sheet and in the outstanding stock of reserves, and this is something that the Committee will not be reconsidering from time to time. We think this is a workable plan, and it will as one of my colleagues, President Harker described it, it will be like watching paint dry." See page 17 of the link.

5. Ben Bernanke, "Aiding the Economy: What the Fed did and Why," Washington Post, November 5, 2010 (editorial)

6. Jeff Cox, "Fed Chair Jerome Powell Says the Case for Raising Rates Has Weakened,'" January 30, 2019,

https://www.cnbc.com/2019/01/30/fed-chair-jerome-powell-says-the-case-for-raising-interest-rates-has-weakened.html