Prices, Profits and Ordered Anarchy versus Shortages and Central Planning

SUMMARY:

An engine that runs without an human operator, requires a governor for control. An engine requires a governor to control its speed. Much can be understood about the workings of a large national economy by considering the economy to be an engine.In the same way a governor controls an engine, an economy uses prices and profits to distribute the limited economic inputs of land, labor and capital to produce an optimum level of production. When the economic signals provided by prices and profits are shunted by central planning, central bankers and central governments, an economy will not operate in an optimum manner. A manifestation of this faulty operation is a shortage of goods. Examples of these types of shortages are provided by those experienced in the former USSR, and those being experienced now as a consequence of the post-Covid responses of governments and central banks around the world.

DISCUSSION:

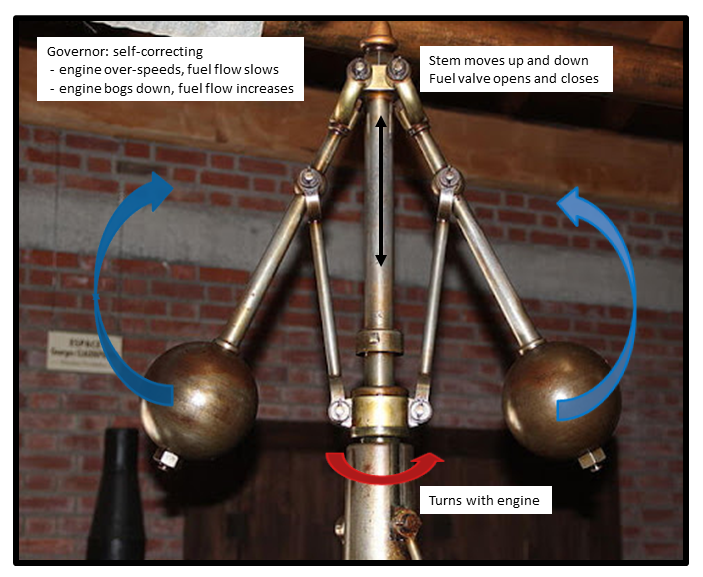

Figure 1 shows a mechanical governor. Before the advent of digital technologies, mechanical governors such as these were used to control an engine's speed. As shown in Figure 1, the vertical stem rotates with the engine. As this stem rotates, centrifugal force causes the two metal spheres to move. As the engine moves faster, the spheres will move up and force the stem down. As the engine rotates slower, the metal spheres drop and this forces the vertical stem up. The stem is connected to the engine's fuel valve by a mechanical linkage. A downward stem movement, (caused by the engine running faster), reduces the flow of fuel to the engine and reduces the engine speed. In the same way, an upward stem movement, (caused by the engine running slower), increases the flow of fuel to the engine and increases the engine speed. In both cases, the governor, returns the engine to its desired speed without any input from an operator.

A free economy works in a similar manner. However, the function of the governor in an engine is replaced by the function of prices and profits in an economy. In an economy, prices and profits will return an economy, not to its desired speed, but to its optimal production level. For example, a free market economy will spontaneously react to the signals generated by higher prices. The immediate response to a rise in price of a good will be the tendency of people or businesses to purchase less of it. If prices remain high and are accompanied by higher profits to the producer of the good, then additional factors of production will be dedicated to producing the good. Of course, the response by producers to make more of the now more profitable good, may take some time. For example, crops will have a growing cycle while other commodities like oil, gas, iron ore, and industrial metals may require large capital investments before additional production can be brought online. The mechanism described here is summarized by the free market maxim, "the cure for high prices is high prices."

FIGURE 1: Engine Governor (Self-Correcting)

If prices and profits are not used for spontaneous control of an economy, then something else must be used in their place. As history has demonstrated, what is often used in place of prices and profits is central planning. In a system of central planning - and the USSR was the archetypal example - an all-powerful bureaucracy, buttressed by an even more powerful state, makes all economic decisions. Specifically, a central planning bureaucracy determines how much of each good should be produced. However, because these edicts are not accompanied by the signals produced by prices and profits, the various factors of production can't distribute themselves to support these edicts.

The most obvious - and historically most significant - manifestation of the breakdown between the edicts of central planners and the ability of an economy to carry them out is the USSR. In spite of its enormous landmass - which included perhaps the richest granary in the world, the Ukraine - the USSR had a difficult time keeping its people fed. As the Soviet experiment with central planning reached its terminal levels of inefficiency and idiocy, supermarket shelves went empty, prompting Soviet citizens to joke, "They pretend to pay us, we pretend to work." See Figure 2. A stunning contrast with the inefficiencies of central planning is provided by the fact that in 2021 Russia - without the benefit of the Ukraine - became a net exporter of food. (1)

FIGURE 2: They Pretend to Pay Us, We Pretend to Work

While nothing like the Soviet state exists in the United States, the same pernicious effects of central planning can occur. In the United States - and throughout the West for that matter - recent central planning efforts have been precipitated by a combination of central banks and central governments. The pernicious effects produced by central planning don't have to show up as shortages. Instead, they often show up as asset bubbles. Indeed, the US housing bubble provides an example of a classic asset bubble. This bubble was sparked by a perfect storm of an activist central government - Bill Clinton divining 67.5% as an optimum level of US home ownership - and an activist central bank - the Greenspan/Bernanke Fed sending rates to historic lows and keeping them there even as home prices soared.

CONCLUDING REMARKS:

The ability of a free economy to spontaneously return itself to an optimum production level using nothing more than prices and profits has been demonstrated time and time again. Wilhelm Ropke summarized this phenomenon as 'ordered anarchy;'

"Who is charged with seeing to it that the economic gears of society mesh properly? Nobody. No dictator rules the economy, deciding who shall perform the needed work and prescribing what goods and how much of each shall be produced and brought to market...Thus, the modern economic system, an extraordinarily complex mechanism, functions without conscious central control by any agency whatsoever. It is a mechanism which owes its continued functioning really to a kind of anarchy....Political anarchy leads invariably to chaos. But anarchy in economics, strangely, produces an opposite result; an orderly cosmos." (2)

The widespread shortages being experienced today - most spectacularly with computer chips - are not a consequence of the free market. Instead, these shortages are likely the result, at least in part, of all the post-Covid responses of central banks and central governments around the world. Millions of people are being paid more money not to work than they earned from working. Many of these people are not returning to work, or are only willing to return if their pay is greatly increased. Trillions of dollars have been created out of thin air by central banks to support all sorts of deficit spending by governments. All these programs, in whatever form they take, are proverbial shocks to the economic system. They were not preceded by any pricing or profit signals, and, as a result, the economy had no opportunity to reorganize itself to support all the new economic decisions prompted by these programs. From an economic organization standpoint, these programs are no different than a Soviet central planner deciding how much pig iron should be made in Cherkassy and how much fertilizer should be produced in Kharkov. The shortages now being experienced in all sorts of industries all over the world provide mute testament to this similarity.

Peter Schmidt

September 12, 2021

Sugar Land, TX

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found Twitter @The92ers.

ENDNOTES:

1. "Russian Becomes a Net Exporter of Food for First Time in post-Soviet History," March 10, 2021

https://www.rt.com/business/517625-russia-food-net-exporter-record/

2. Wilhelm Ropke, Economics of a Free Society, The Ludwig von Mises Institute, Auburn Alabama, 2008, pp. 3-4 (Originally published as Die Lehre von der Wirtschaft in Vienna, 1939.