Inflation: One of the Many Things an MIT PhD Knows Nothing About

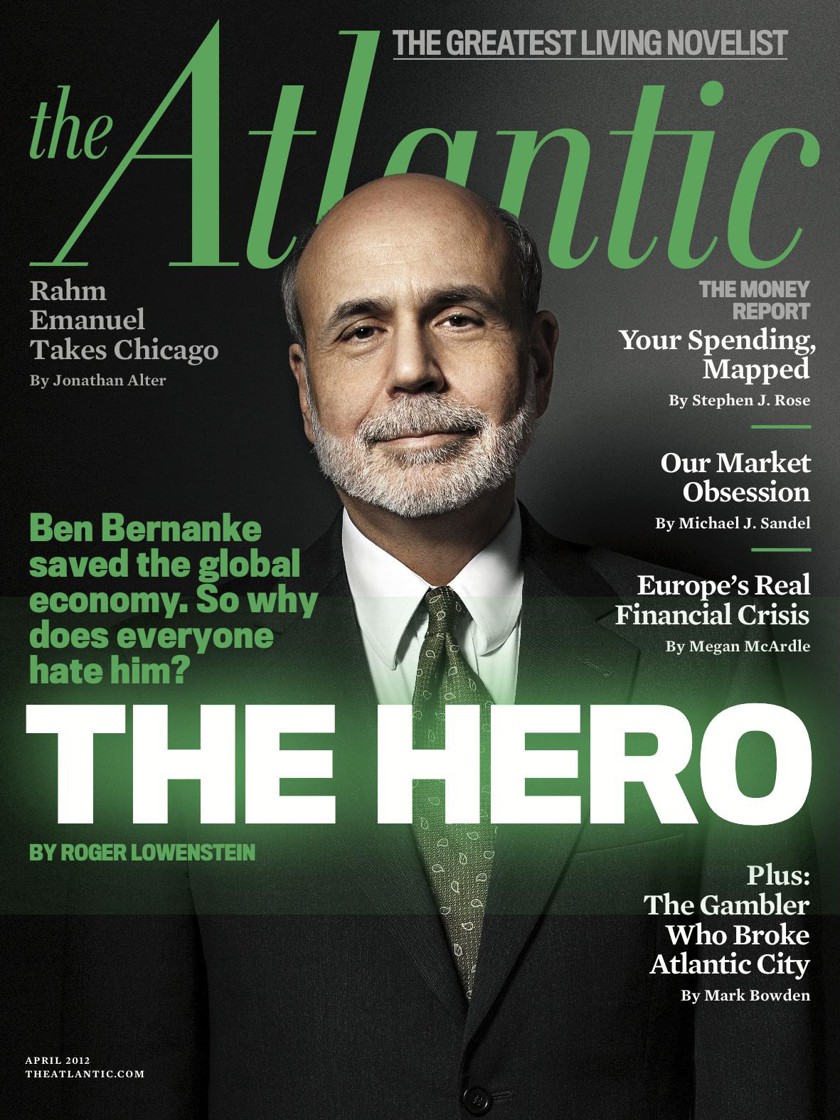

Ben Bernanke fancies himself as an economic super-hero. Given his leading economic role in the years immediately leading up to the crisis - he was a member of the Fed's open market committee (FOMC) from 2002-2006 and Fed chairman 2006-2014 - this is a pretty remarkable conclusion for Bernanke to reach. In his defense, he has heard nothing but praise from the financial media who universally hail him for single-handedly saving the economy. This belief is trenchantly expressed in what must surely be the most absurd magazine cover from the entire financial crisis era.

The enormous amount of praise Bernanke received from all media corners notwithstanding, the praise has a common theme; what a happy coincidence that one of the world's leading experts on the Great Depression was running the Fed when the country was threatened with another Great Depression. Of course, latent in this theme is what appears to be a willful blindness to the role Bernanke and the Fed might have played in bringing the country to such dire financial straights. Its a willful blindness that applies to the Fed's enormous role in causing the original Depression as well. (1)

However, the biggest blindspot in the 'happy coincidence' theory of Ben Bernanke's Depression-era expertise is his purported Depression-era expertise! In fact, in one of his first speeches as a member of the FOMC, Bernanke completely exposed an enormous gap in his understanding of the Great Depression. Not only did this speech expose Bernanke's fundamental misunderstanding of the Depression era, it completely explains why the Fed Bernanke served on (2002-2005 & 2006-2014) was completely asleep at the wheel when one of the largest financial bubbles in history blew up under the Fed's collective noses!

On November 08, 2002 Ben Bernanke gave a speech in honor of Milton Friedman’s ninetieth birthday. (2) In this speech, Bernanke provides his – and Friedman’s - theory of the Great Depression. Friedman concluded the Fed caused the Great Depression by allowing the money supply to collapse during the 1930s. In his analysis, Friedman first attempts to show those times – Bernanke calls them “monetary policy episodes” - during the Depression era when the money supply changed for reasons “plausibly unrelated to the state of the economy.” With these episodes identified, Friedman reasoned it would then be possible to determine how changes in the money supply caused changes in the economy. The Friedman thesis purports to show the Great Depression can “reasonably be described as having been caused by monetary factors,” or changes in the money supply drove changes in the economy. When the money supply fell the economy slumped. When the money supply increased, the economy recovered.

What the Friedman analysis of the Great Depression – and Ben Bernanke’s endorsement of it in November 2002 – really shows has nothing to do with the Depression. Instead, the analysis and Bernanke’s endorsement of it exposes what is the Fed’s overarching blunder of the Greenspan/Bernanke era – the failure to understand one word, inflation. The first “monetary policy episode” Bernanke cites as proof that the Fed caused the Great Depression was the policy tightening that began in the spring of 1928. Bernanke criticizes the Fed for raising interest rates during this period because – in his opinion – there wasn’t “the slightest hint of inflation.”

The Federal Reserve during much of the 1920s acted in a criminally irresponsible manner. The historical record makes it clear that the Fed acted the way it did – by slashing rates and pursuing an easy money policy – to advance the economic interests of Great Britain and its central bank chief, Montagu Norman. In spite of the Fed’s reckless policies, the price of consumer goods changed very little during the 1920s. (3) Because of this, Bernanke – and Friedman – conclude there was no inflation in the 1920s.

Unfortunately for their analysis there were a variety of secular trends – primarily the Industrial Revolution – that produced enormous increases in productivity, and these helped to keep consumer good prices down in the 1920s. Where the Fed’s unwarranted increase in the money supply, the classical definition of inflation, in the 1920s manifested itself was in the price of assets – stocks and real estate in particular.

See the chart above and the period from spring 1928 to October 1929. Note stock prices rising to the stratosphere. (Stock prices are in blue and interest rates are in green.) This is what Ben Bernanke means - foolishly it hardly needs to be added - when he says "not the slightest hint of inflation." As the chart makes clear, even with the benefit of hindsight Ben Bernanke completely misdiagnosed the 1920s stock bubble. Ben Bernanke relies on an artificially narrow definition of inflation that is confined to consumer prices, and this makes him blind to inflation as measured by even huge increases in asset prices. Stable consumer prices are no proof that credit is not being expanded too liberally or the risk of a financial bubble is low. Indeed, financial bubbles are most likely to occur when goods prices are relatively stable – the Great Depression and the Financial Crisis of 2008 provide ample evidence of this. In his misdiagnosis of the 1920s stock bubble Ben Bernanke exposes exactly the same mindset that made him and the Federal Reserve blind to the enormous risks associated with the ballooning costs of homes in the early 2000s.

As his misunderstanding of the nature of 1920s-era inflation conclusively demonstrates, Ben Bernanke isn't an expert on the Great Depression. He doesn't know the first thing about it.

Peter Schmidt

Sugar Land, TX

February 09, 2020

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. http://www.the92ers.com/blog/great-depression-timeline-fed-and-bank-england-had-baby-and-they-called-it-great-depression

2. https://www.federalreserve.gov/BOARDDOCS/SPEECHES/2002/20021108/

3. http://www.the92ers.com/blog/stabilationists-great-depression-and-preview-todays-purported-economic-ideal-2-inflation