The Fed - Capitalizing on the Chaos it Creates; A Timeline of the Great Depression

I was at the New Orleans Investment Conference last week and wasn't able to prepare a blog post. This week's post is a companion piece to the one written two weeks ago on the CIA.

http://www.the92ers.com/blog/cia-federal-reserves-equal-capitalizing-chaos-it-creates

That article described how the CIA capitalizes and accumulates power as a direct result of - not its success (which are virtually non-existent) - but its failures. Moreover, the more spectacular the failure created by the CIA's ham-handedness, the greater the resulting accumulation of power. The example of Operation Ajax - the name given to the CIA's 1953 coup in Iran - was used to make this point.

Exactly like the CIA, the Federal Reserve also capitalizes on its own blunders to accumulate power. The powers the Fed had accumulated since its 1913 founding would leave the architects of the Federal Reserve Act absolutely dumbfounded. The vast majority of the unsanctioned power the Fed has accumulated is the direct result of the Fed's largest mistake, the Great Depression.The most popular theory surrounding the Great Depression is a passive Fed - stubbornly wedded to old, conservative ideas - caused the Depression by allowing prices to collapse. It is a remarkably silly argument for several reasons, two of which I will list here;

- Falling prices weren't the cause of anything. Falling prices were a consequence of the economic chaos produced by a massive credit bubble deflating, the shock resulting from promises made in gold being broken and the 'regime uncertainty' associated with massive and unprecedented government interference in the economy after the stock bubble collapsed, (the New Deal).

- If Fed passiveness caused the Great Depression, then how did the US ever avoid a Great Depression when there wasn't even a Fed to take actions the Depression era Fed was criticized for not taking!

Point 2 is an especially trenchant point and anyone who understands its simple logic must surely realize that it wasn't Fed passiveness that caused the Depression - otherwise there would have almost certainly been a Great Depression before the Fed's founding in 1913. However, from the standpoint of the Fed, criticism of the 1920s Fed for being too passive is heaven sent. Obviously, if the Great Depression was caused by the Fed being passive, then the solution to avoiding another Great Depression is a more active and more powerful Fed.

Over the next few weeks, I am going to discuss the Great Depression and all the things that the Fed - and others - did to cause it. Among the points to be discussed will be;

- The huge volume of uneconomic loans incurred by the Allies (England, France and Russia) to purchase weapons from the United States during World War I. (Hint: war isn't good for a countries prosperity or economy)

- Benjamin Strong (NY Fed) and Montagu Norman (Bank of England) secretly enacting policies to benefit Great Britain, culminating in a secret conference of central bankers on Long Island. (July 1927)

- The Smoot-Hawley Tariff (June 1930)

- England - in a great act of national cowardice and shame - reneging on its obligations under the gold standard. (September 1931)

- The Schechter Poultry Case and the Economic Chaos endemic to all New Deal Legislation (May 1935)

- The Wagner Act, the GM Sit-Down Strike and the Labor Unrest that Caused the 'Depression within the Depression' (August 1937)

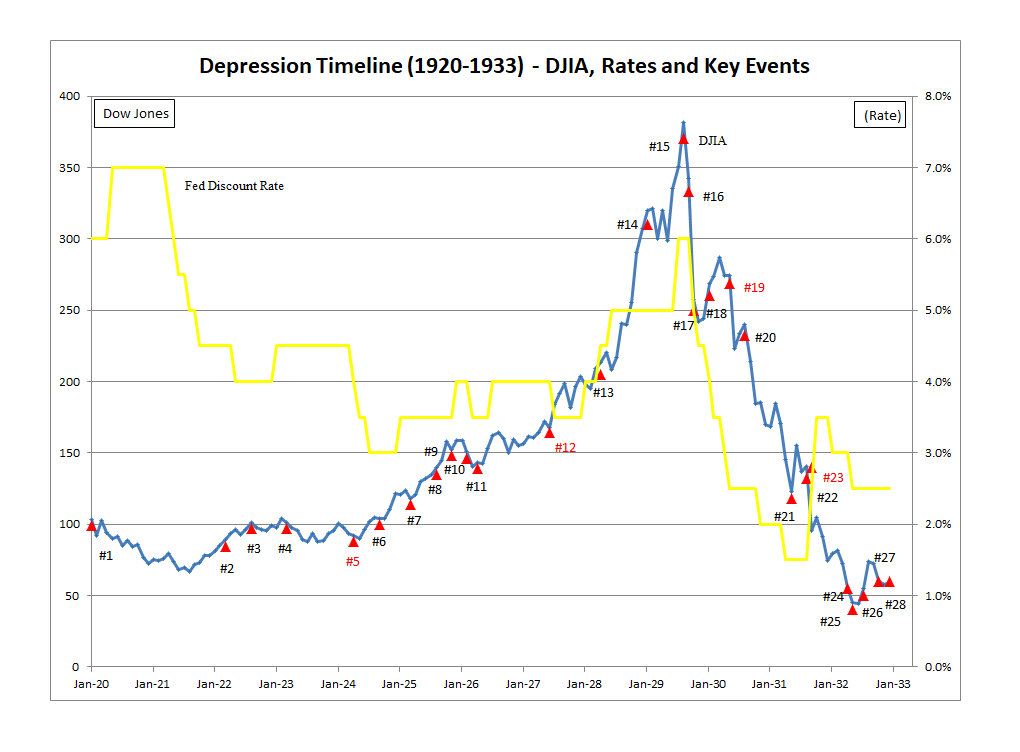

In advance of all that, see the chart below for a snapshot of the Great Depression Era from 1920-1933. The Chart includes the Dow Jones average (blue) and the Fed's discount rate (yellow). The Dow Jones is a proxy for economic activity and the discount rate a proxy for the Fed. While a stock market average is not a good proxy for an economy in an absolute sense, it is very good when used on a relative basis. In other words, more important than the absolute level of stock prices is whether the market goes up or down at a particular point. As will be described later, milestone events almost always have an immediate impact on the stock market and the direction of the market's movement can be used to understand the impact from that milestone event. (See for example #12 and the stock market taking off as a direct result of the July 1927 conference of central bankers or #19 and the market rolling over after the Smoot -Hawley tariff was passed.)

- Prohibition; Economy enters depression; British pound at a low (JAN 1920)

- Genoa Conference, gold exchange standard (APR 1922)

- Fordney-McCumber Tariff passed (SEP 1922)

- Fed holds its first Open Market Committee meeting (APR 1923)

- Ben Strong admits to Andrew Mellow that loose money policy is to benefit Britain (MAY 1924)

- Montagu Norman encourages Strong to continue with easy money (OCT 1924)

- British Pound returned to its pre-war dollar parity (APR 1925)

- Bankers plead with Wall Street to stop German lending (SEP 1925)

- Wall Street banks set up German offices to solicit loans (DEC 1925)

- Stabilization hearings in the United States (MAR 1926)

- General Strike in the United Kingdom (MAY 1926)

- Long Island Conference of Central Bankers (JUL 1927)

- Nazi party wins 3% of the vote in German elections (MAY 1928)

- Fed policy "drifting," Fed warns of credit "seepage" (FEB 1929)

- Stocks peak (SEP 1929)

- "Greatest economist" claims that stocks are at a 'permanently high plateau' (OCT 1929)

- Stocks crash; Hoover implements high wage policy (OCT 1929)

- Grain Stabilization Corporation (GSC) formed (FEB 1930)

- Smoot-Hawley Tariff passes (JUN 1930)

- Nazi party wins 18% of the vote in German elections (SEP 1930)

- Austria suffers credit collapse (JUN 1931)

- Germany suffers credit collapse (AUG 1931)

- Britain abandons gold; monetary chaos unleashed (SEP 1931)

- Massive purchase of government paper by Fed (May 1932)

- Revenue Act of 1932 passive; massive tax increase (JUN 1932)

- Ottawa Imperial Conference; foreign trade shuts down (AUG 1932)

- Nazi party wins 33% of the vote in German elections (NOV 1932)

- FDR's sphinx like science inspires banking panic (JAN 1933)

There will a lot of information to go over but it will prove well-worth the time to do so. It is the failure to understand and learn from the mistakes of the 1920s and 1930s that has allowed the Fed to accumulate the power it has, for wealth to be as concentrated as it now is and for the overall economy to become 'financialized.'

Peter Schmidt

Sugar Land, TX

November 10, 2019

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers