Exactly How Does the Fed Fertilize the Rich Man's Field with the Sweat of the Poor Man's Brow?

In last week's article Charles Holt Carroll's adage of inflation being "the surest way to fertilize the rich man's field with the sweat of the poor man's brow" was discussed. (1) In that article inflation wasn't defined as an increase in prices. Rather, inflation was described purely on the basis of the money supply. In Jim Grant's working definition of inflation, inflation is 'pure and simple, too many dollars.' The point of defining inflation purely in monetary terms, independent of prices, is of enormous practical significance. Namely, an economy is comprised of all sort of prices and these prices do not respond in the same way to a monetary inflation. To avoid this confusion - and central banks rely on the thinking around inflation to be muddled - it is best to first discuss inflation in monetary terms only.

Of course, when the money supply is growing much faster than the economy, nearly all prices will move higher, price inflation, particularly over the long-term. Among the prices reviewed last week was the price of electricity. Figure 1 below uses data from the Energy Information Administration and plots the price of electricity, (cents per kilowatt-hr), for the years 1960 - 2018. (2) For the years 1960-1970 the price of electricity was falling. Ben Bernanke and the entire Federal Reserve are terrified of falling prices - which they call 'deflation.' In reality, a healthy economy, by virtue of productivity enhancing capital investments, should produce falling prices. Indeed, how can an economy and a society become more productive without this productivity manifesting itself, at least in part, by falling prices?

The price being plotted in Figure 1 is the single most important goods price in any modern economy, and the building block upon which society is built. (Society as we know it would cease to exist without electricity.) In addition, the size of the electricity generation industry - particularly as size is measured by capital investments and not the market capitalizations of the companies involved in the industry - dwarfs any of the 'hi-tech' industries of today. Could there be a better demonstration of the complete and total intellectual bankruptcy of the Fed's fear of 'deflation' than the electricity price data for 1960-1970 presented here?

FIGURE 1

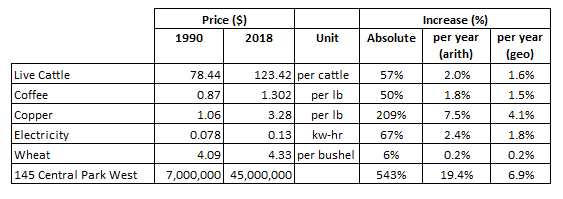

Perhaps it is the Fed's fear of 'deflation' - falling prices in the Fed's parlance - that explains the price behavior of the commodities shown in Table 1. While the price of wheat has changed little over the years 1990 - 2018, all the other key commodities here have seen their price increase of more than 50%. (See Endnotes 3-6 for the prices of live cattle, coffee, copper and wheat respectively). However, even the price increase of copper - fueled as it was by surging demand from China and elsewhere - pales in comparison to the price increase of 145 Central Park West. What is 145 Central Park West?

TABLE 1

145 Central Park West refers to the triplex apartment in the south tower of the San Remo apartment building in New York City. In Figure 2, the view is looking west; that is Central Park in the foreground and 145 Central Park West is to the south (left). The apartment at issue comprises the upper three floors of the south tower. Because of its unobstructed views looking south toward Central Park and much of Manhattan, the penthouse triplex in the south tower is much more valuable than its twin in the north tower. Just how valuable is the triplex apartment in the south tower? It was sold, by Demi Moore, for $45-million in 2017. (7) (Apparently, Bono has to make do with the obstructed terrace views in the north tower triplex).

FIGURE 2

Some perspective is needed on the $45-million sale price. The San Remo was completed in 1930 - just as the Great Depression was really starting to pick up steam. As it was nearing completion, the entire building was valued at $10-million. In 1940, the San Remo - along with another glamorous New York City apartment building, the Beresford, were sold for the cost of their outstanding mortgages plus $25,000. (8) While the Fed and Modern Monetary Theorists (MMT) are loathe to admit it, the original construction cost of the San Remo carries an enormously important economic truth. Namely, that the increased circulation of money contributes precisely nothing to a wealthier society.

The San Remo was built for $10-million while any attempt to do something similar today would surely run into the many hundreds of millions of dollars. For the sake of the discussion here, assume a 'modern' San Remo was built and it cost $400-million to duplicate the original construction from 90-years ago. Does the fact that the San Remo of today costs 40-times more than it did in 1930 imply that the modern San Remo building is 40-times more valuable or its mere presence makes society 40-times wealthier than it was in 1930? It's the sort of question that anyone with commonsense can instantly answer in the negative. Its the same building; how could it now be 40-times more valuable? The higher cost of today's San Remo isn't a reflection of the building becoming more valuable than its 1930 counterpart. Instead, its a reflection of the unit of value measurement, dollars, greatly decreasing in value.

As the 'unit of value measurement' decreases in value, the dollar prices of goods don't all change at the same time or by the same amount. A review of Table 1 shows the price of Manhattan trophy real estate increased far more than the price of any of the commodities shown. Production of any of these commodities requires real physical effort, (sweat), and real value added work. In contrast, outside of redecorating it an 'southwestern motif,' Bruce Willis and Demi Moore didn't have to do much at all to 145 Central Park West and its price exploded by 543%! The figures in Table 1 scream one thing the loudest; coffee growers, copper miners and cattle ranchers would have all been better off if they had pooled their resources and purchased Manhattan real estate, instead of sweating to provide food and industrial metals to the rest of us. Under what basis does this state of affairs make any sense economically, much less morally? In fact, isn't this exactly the state of affairs that Carroll railed against?

THE BOSKIN COMMISSION

One final point on the data in Table 1. Note that the rate of increase is calculated in both arithmetical and geometric terms. The arithmetical increase is evaluated simply by taking the total percentage increase and dividing it by the number of years. The geometric rate of increase is calculated using logarithms. Geometric increases are those normally associated with things such as populations, where the rate of increase is fixed even as the size of the object undergoing the increase gets larger and larger. Traditionally, inflation rates were calculated on an arithmetical basis, and that is consistent with how prices should behave. However, at the urging of Alan Greenspan and other stars of the economic firmament, the Boskin Commission revisited how inflation was calculated. (Michael Boskin was an economics professor at Stanford) The Boskin Commission recommended inflation be calculated on a geometric basis. (9) This subtle change helps to mask the disastrous impacts of the monetary inflation the Fed has unleashed on the US economy. This change takes the annual increase in electricity cost from 2.4% to 1.8% - a 25% reduction in (price) inflation rate!

CONCLUDING REMARKS:

As shown here, what makes inflation 'the surest way to fertilize the rich man's field with the sweat of the poor man's brow' is the different impact in terms of time and magnitude a monetary inflation has on prices in an economy. Because a central bank injects money into an economy through the financial system, financiers and bankers have the enormous benefit of having access to additional money before this money has forced prices in the economy overall to increase. (Manhattan real estate is an asset that is obviously attached to finance and banking, even if the apartment discussed here was purchased by movie stars.)

The great Frederic Bastiat captured how a monetary devaluation via inflation causes price increases to cascade through an economy and how different groups of people will fare when different prices change at different times;

"...No doubt, but only think what disturbances, what cheatings are produced in exchanges when the value of the medium varies, without our becoming aware of it by a change in the name. Old pieces are issued, or notes bearing the name twenty-francs, and which will bear that name through every subsequent depreciation. The value will be reduced by a quarter, a half, but they will still be called notes of twenty-francs. Clever persons will take care not to part with their goods unless for a large number of notes - in other words they will ask forty francs for what they would formerly have sold for twenty; but simple persons will be taken in. Many years must pass before all values will find their proper level. Under the influence of ignorance and custom, the day's pay of a country laborer will remain for a long time a franc, while the saleable price of all articles of consumption around him will be rising. He will sink into destitution without being able to discover the cause."

Perhaps someone should pass this article along to the Fed's Jerome Powell. He claims the Fed has nothing to do with the concentration of wealth.

Peter Schmidt

Sugar Land, TX

June 14, 2020

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. http://www.the92ers.com/blog/fed-fertilizing-rich-mans-field-sweat-poor-mans-brow

2. Electricity prices are residential cost of electricity and the data comes from two sources, both from the US Energy Information Administration.

For 1960 - 2011, see https://www.eia.gov/totalenergy/data/annual/showtext.php?t=ptb0810

For 2011 - 2018, see https://www.eia.gov/electricity/annual/html/epa_01_02.html

3. Historical Cattle Prices, Iowa State Extension and Outreach, https://www.extension.iastate.edu/agdm/livestock/html/b2-12.html

4. Coffee Prices; https://www.macrotrends.net/2535/coffee-prices-historical-chart-data

5. Copper Prices, https://www.macrotrends.net/1476/copper-prices-historical-chart-data

6. Wheat Prices, https://www.macrotrends.net/2534/wheat-prices-historical-chart-data

7. "Demi Moore Finally Sells San Remo Penthouse for a Much Reduced $45-million," Annie Dodge, 6sqft, 20 APR 2017. The article indicates the 'rumored' purchase price was $7-million in 1990. The sale price in 2017 was $45-million. Both of these prices are being used in this analysis.

https://www.6sqft.com/demi-moore-finally-sells-san-remo-penthouse-for-a-much-reduced-45m/

8. "Ten Fun Facts About the San Remo Luxury Apartment Building in New York City," Untapped New York, 30 JUN 2017 https://untappedcities.com/2017/06/30/10-fun-facts-about-the-san-remo-luxury-apartment-building-in-nyc/5/

9. "Final Report of the Advisory Commission to Study the Consumer Price Index," December 1996, p.2 "The BLS should change its procedure for combining price quotations to geometric means at the elementary aggregates level."