Cause and Effect: The Ivy League and the Financial Crisis

SUMMARY:

We didn't have a financial crisis in spite of so many political, central bank and Wall Street power brokers graduated from Ivy League universities. Instead, we had a financial crisis because so many political, central bank and Wall Street power brokers graduated from Ivy League universities.

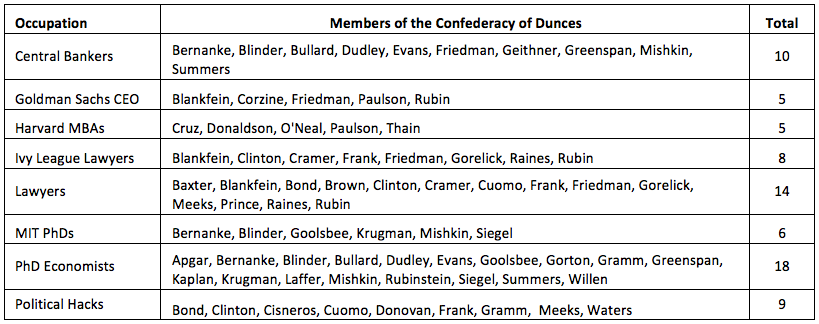

Of the 50 people I list as being the main causal agents of the financial crisis, there are a total of 57 Ivy League degrees, including 28 from Harvard alone. See Table 1. Some other interesting facts? There are 16 PhD economists, 6 MIT PhD economists and 8 with Ivy League law degrees. (Because of the baleful influence of its economics department, MIT is listed here as an Ivy League school.) See Table 2.

TABLE 1: Ivy League Degrees Among the Confederacy of Dunces

Table 2: What these Dunces Do:

DISCUSSION:

In what may come as a huge shock to people who never attended an Ivy League college, Ivy League schools no longer maintain a Dean's List. While Ivy League faculty, students, and alumni almost universally look back on the past with complete and utter contempt, it was not self-righteous disdain for the past or a passing contemporary fad that led the Ivy League schools to discard their Dean's Lists. Instead, the Ivy League schools - led as they always are by Harvard - realized Dean's Lists were meaningless because nearly all students were on them! In fact, when Harvard's Dean of the College, Harry R. Lewis, proposed eliminating the Deans List in October 2002, 92% of Harvard's undergraduates were on the Dean's List. What a joke!

The best evidence of the completely farcical nature of Ivy League Dean's Lists and the contemptuous ease which students earned a place on them is the "Confederacy of Dunces" list compiled on this site. In this list of individuals - which is festooned with Ivy League graduates - the fifty people most responsible for causing the financial crisis were discussed. To be sure, a variety of causes coalesced and contributed to the financial crisis being as large as it was and to occur when it did. Among these various causes, three warrant special attention;

- President Clinton's strategy, (read "central plan"), to increase homeownership to 67.5%

- Wall Street's mistaken belief - which was fueled by academia - that highly leverage investments could be managed with computer models of the economy

- The completely emboldened Federal Reserve of the Greenspan/Bernanke era

As important as the three causes listed above were to causing the financial crisis, none of these rises to the level of being a true root cause. Instead, each of these causes was merely a manifestation of the crisis' true root cause - which was purely a human factor.

This human factor is the completely false sense of omnipotence, self-importance and entitlement among the country's elite, as well as the nurturing of these beliefs at Ivy League colleges and other elite universities.

It was only because so many of the individuals working in the Clinton White House, on Wall Street and the Fed were equal parts confident in their own supposedly supreme abilities and contemptuous of the notion that other people were just important as they were, that these organizations acted the way they did.

For anyone who doubts the Ivy League's role in the financial crisis, two things are worth considering. First, the most popular major at Ivy League schools is almost certainly economics, and lousy economic theory was at the core of the financial crisis. Moreover, the most popular career destination for these Ivy League graduates is almost certainly Wall Street. Furthermore, many of the economics majors who don't go to work on Wall Street go on to careers in academia or the Federal Reserve. As either professors or central bankers, these Ivy League economics majors are then in a position to cause more damage to the country than even their Ivy League counterparts on Wall Street; that is saying something!

Second, and the primary objective here, note the sheer number of Ivy League and elite university degrees awarded to the Confederacy of Dunces; again, see Table 1. The individuals with Ivy League and other elite university degrees includes central bankers, congressmen, senators, Wall Street executives, cabinent secretaries, columnists, professors and even a president. Is it really to be believed that the enormous number of Ivy League and elite university degrees awarded to the Confederacy of Dunces is a mere coincidence and not a more fundamental causal agent?

Any analysis of the financial crisis that doesn't recognize the purely human factor among the nation's (so-called) elite, and the nurturing of this human factor at (so-called) elite universities as the cause of the financial crisis is doomed to failure. More importantly, until this purely human factor is addressed, the US will be doomed to suffer other future calamities, every bit the equal of the financial crisis. These future calamities - whatever they are - will be exactly like the financial crisis in one aspect; they will be caused by some other small cadre of 'elites in name only' who arrogantly believe that their elite university education makes them completely capable of inerrantly planning, managing and controlling the country.

Peter Schmidt

November 15, 2020

Sugar Land, TX

P.S. - As always, if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the financial crisis and the long-running problems that led to it.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers