Bernanke - 'Central Banks an Important Source of Moderation;' Not Quite

On February 20, 2004 Ben Bernanke gave one of the most remarkable speeches of his lengthy Fed career; he served at the Fed from 2002-2005 and 2006-2014. He claimed "improvements in monetary policy, though certainly not the only factor, have probably been an important source of the Great Moderation." (1) The Great Moderation was a term economists and central bankers came up with to explain the purported - and completely mythical - claim that modern economies, controlled as they are by central banks, were benefiting from reduced economic volatility. In others, words, economies weren't subject to the huge swings between booms and busts that they had been, and central banks were a large contributor to this salutary benefit.

It was a remarkable time for Ben Bernanke to pass himself off as some sort of economic savant or soothsayer, particularly so when it came to the beneficial impact of central banks. While Bernanke was taking credit for all the great things central banks were doing to economies around the world, the housing bubble that Bernanke and his Fed colleagues were laboring day and night to blow up, was two months from reaching its zenith! In terms of homeownership, the housing bubble peaked in April 2004 - just two months after the Great Moderation speech was given! (See Figure 1)

FIGURE 1:

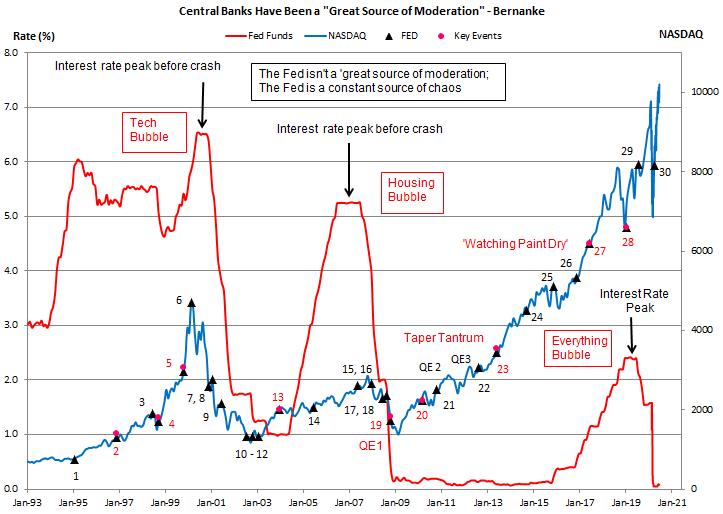

More generally, the past 25-years have proven to be the most chaotic in US economic history, not the most placid or serene! After going seventy-years without a bubble, the US economy has suffered from three bubbles in just the past 20-years. Two of these bubbles have already popped and caused tremendous damage when they did. The third and current bubble - which is much bigger than the previous two bubbles put together - is only being sustained by unprecedented central bank intervention. Fed apologists - and media and academia is littered with them - claim that today's distortions are the result of the global pandemic. In fact, nothing could be further from the truth and this is demonstrated in Figure 2 and the corresponding list of events.

FIGURE 2

- FEB '95 - Greenspan & Robert Rubin bailout Mexican bondholders

- DEC '96 - Greensan's "irrational exuberance" speech (KEY)

- JUL '98 - Greenspan, Rubin & Lawrence Summers (all dunces) fight to keep the market for derivatives deregulated

- OCT '98 - "Most irresponsible act" in Fed history - Greenspan engineers a between meeting rate cut after hedge fund LTCM collapses (KEY)

- NOV '99 - portions of Glass-Steagall repealed (KEY)

- MAR '00 - Greenspan speaks at Boston College, extols "new era" economy days before NASDAQ peaks

- DEC '00 - speaking for most other economic PhDs, Paul Krugman (Dunce #31) claims economy can almost always be controlled by manipulating interest rates alone

- FEB '01 - a senior Fed officials claims the post-tech bubble hangover can be cured if enough people "go out & buy an SUV."

- JUL '01 - Greenspan confuses rapidly escalating home prices with real wealth

- AUG '02 - Greenspan speaks at Jackson Hole, WY and disavows any responsibility for the tech bubble

- NOV '02 - Ben Bernanke delivers his "helicopter speech" and claims financial system is "well-regulated"

- FEB '03 - w/ interest rates at historic lows, Greenspan recommends homeowners use adjustable rate mortgages (ARMs)

- NOV '04 - Bernanke claims the Fed's monetary policy has led to a "great moderation" of reduced economic volatility (KEY)

- JUL '05 - Bernanke dismisses prospect of a housing bubble

- JUN '07 - Bernanke clams the "mortgage debacle" won't negatively impact the economy

- JAN '08 - Bernanke claims the economy is in the process of "healing itself"

- JUL '08 - Bernanke claims the two mortgage giants, Fannie Mae and Freddie Mac, will "make it through the storm"

- SEP '08 - acting on its own volition, the Fed initiates a $100-billion bailout of AIG (really a gift to AIG's trading partners)

- NOV '08 - Fed launches its first round of quantitative easing (QE1) (KEY)

- MAR '10 - Bernanke testifies to Congress; Fed will get balance sheet below $1-trillion (KEY)

- NOV '10 - Fed launches QE2

- SEP '12 - Fed launches QE3

- JUN '13 - Fed threatens to "taper" QE, market throws a "taper tantrum" (KEY)

- OCT '14 - Fed halts QE

- DEC '15 - in the only interest rate hike of the Obama presidency, the Fed raises rates (0.25%) for the first time since the crisis

- DEC '16 - perhaps not coincidentally, after the election of Donald Trump the Fed initiates a series of interest rate hikes

- JUN '17 - Yellen predicts Fed cutting the balance sheet will be 'like watching paint dry' (KEY)

- JAN '19 - Powell, after market sell-off, 'case for cutting rates has weakened somewhat' (KEY)

- AUG '19 - long before the COVID crisis, the Fed is cutting rates again

- APR '20 - Fed expands balance sheet by $2.3-trillion in response to COVID crisis

KEY events are in red in the plot and BOLD in the list.

Figure 2 makes it clear that the Fed doesn't solve problems, it breeds them. With each collapsing bubble, the Fed slashes rates and expands credit. As rates plummet and credit becomes easily available, a new, much bigger bubble, rises from the ashes of the one that just burst. Also, note the extraordinary interventions the Fed has taken to protect market participants from suffering losses; the Tequila Crisis (#1), the LTCM debacle (#4) and the AIG bailout (#18). Note also, the two times the Fed interceded to legislatively advance the interests of the concentrated financial power on Wall St; opposing the regulation of derivatives (#3) and endorsing the rollback of Glass-Steagall (#5).

However, what stands out the most in Figure 2 is how often the Fed is wrong. Greenspan gave his most breathless endorsement of the tech bubble exactly four-days before the NASDAQ peaked, (#6). Bernanke dismissed the prospect of a housing bubble (#14), said the economy was 'healing itself' in January 2008 (#16) and predicted Fannie & Freddie would 'make it through the storm,' (#17). Most importantly, when the Fed began its unprecedented campaign of quantitative easing, (QE), the Fed promised QE would be temporary, and Bernanke testified to Congress he expected the Fed to get the balance sheet back below $1-trillion, (#20). Much later, when the balance sheet was above $4-trillion, Janet Yellen said the Fed reducing its QE bloated balance sheet would be like 'watching paint dry,' (#27). Just 18-months after Yellen predicted a drama-free balance reduction program, the Fed was back to cutting rates and expanding its money supply. The money supply was rising and back above $4-trillion long before the virus.

In spite of this dismal record of fueling bubble after bubble, producing the most chaotic twenty-five years in US economic history and being proved wrong on every issue of significance, the Fed has achieved unassailable power. In fact, as the record makes clear, with each succeeding blunder the Fed assumes more power and autonomy, not less!

Peter Schmidt

July 05, 2020

Independence Day Weekend (USA)

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

ENDNOTES:

1. 1. "The Great Moderation," Remarks by Ben Bernanke at the Eastern Economic Association, Washington, DC, February 20, 2004 https://www.federalreserve.gov/boarddocs/speeches/2004/20040220/